How To Build Wealth Instead Of Paying Taxes

New Book Reveals 10 Virtually Unknown Tax Strategies That Could Save You 6 Figures Or More… Even If Your Current CPA Says "There's Nothing More We Can Do"

WARNING: What I'm About To Share Might Contradict Everything You've Been Taught About Taxes...

100% Secure 256-Bit Security Encryption

From: Tiffany Phillips, CPA, MBA

Location: Phillips Business Group Headquarters

You know that moment when you ask your CPA if there’s any way they can reduce your tax bill…

And they look at you like you’re a child who doesn’t know how the world works?

Or they brush you off with: "You should be thankful you're paying this much in taxes - it means you have a successful business."

Or worse...

Maybe they don't even return your calls for days.

Maybe they only want to speak with your husband about YOUR business.

Maybe they make you feel like you're "overstepping" by asking questions about your own money.

I've heard this story hundreds of times.

Successful entrepreneurs being dismissed by the very people who should be helping them keep more of what they earn.

That sick feeling you get every April when you're staring at your tax bill...

Wondering how you're supposed to write a check that big...

While your CPA acts like you should be grateful for the privilege of donating your profits to the IRS.

(which, shocker, is not a charity)

DOWNLOAD "YOUR BIGGEST

EXPENSE" BOOK NOW!

Only $997 $14.95

Save $982.05 today!

DOWNLOAD THE EBOOK FOR JUST $14.95! DELIVERED INSTANTLY.START READING IN NEXT 2 MINUTES.

100% Secure 256-Bit Security Encryption

Bonuses will be delivered instantly.

Get full access right away.

You’re Probably

Paying Too Much Tax

Most business owners are overpaying the IRS by 20-50% every single year…

Which is somewhere between a highway robbery and a nation-wide scam.

The IRS didn't back your business when you were starting out.

They didn't help you take risks or help you grow.

But the moment you find success, they swoop in like vultures ready to tear your profits to shreds.

And the heartbreaking thing is...

Most people let them pick their business clean until every last dollar of profit is gone.

I know because I've seen it firsthand...

Not just with the hundreds of clients I've worked with...

But sitting across from my own father at his kitchen table on one of the worst nights of his business.

Here's what the IRS won't ever tell you (and neither will most CPAs)...

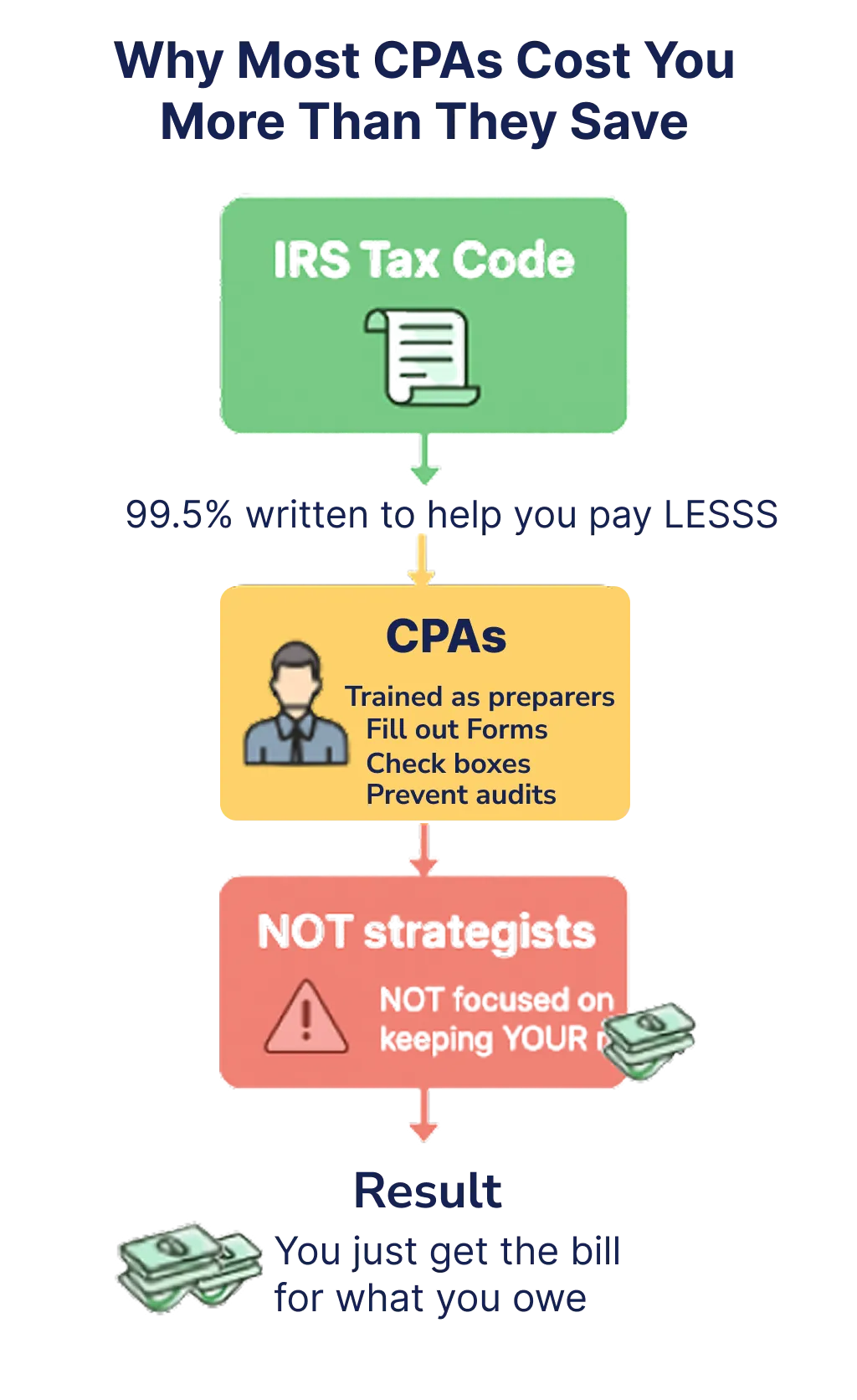

99.5% of the tax code is actually written to help you pay LESS in taxes, not more.

But 90% of CPAs were trained to be tax preparers... not tax strategists.

They fill out forms.

They check boxes.

They make sure you don't get audited.

But they're not proactively looking for ways to keep YOUR money in YOUR pocket.

Instead, they just calculate what you owe and tell you how big of a check to write.

GET INSTANT ACCESS

Today Only - $14:95

INCLUDED WITH YOUR ORDER

"85 Tax Strategies To Save Thousands In Taxes" Mini Course

Covers strategies for businesses of all sizes and industries

Exclusive Tax Bonus Guide

Three powerful bonus tax-saving strategies not included in the book

"Tax Secrets Guide: Reduce Your Taxes & Audit-Proof Your Savings" Audio Course

Complete audio course with accompanying workbook

"Your Biggest Expense" Audio Book

Access tax-saving strategies anytime, anywhere

WORD FROM OUR AMAZING CLIENTS

I Never Planned To Help People Turn Their Taxes Into Wealth…

That changed the night my Dad called me at 11 PM on a random Tuesday.

His voice was shaking.

He'd just had his best year ever with his construction business. Finally hit the numbers he'd dreamed about for decades.

But his tax bill?

It was going to wipe out everything he'd worked for.

Even if he drained every dollar from his bank account, he still wouldn't have enough to pay what the IRS said he owed.

And there I was...

CPA credentials hanging on my wall...

Feeling completely helpless.

I tried everything I knew. Researched every traditional strategy. Called every colleague I could think of.

Nobody could help me save my own father from financial disaster.

That's when I realized everything I'd been taught was focused on compliance... not strategy.

I was trained to work with the tax code as it exists...

Not to find the legal strategies that could actually help people pay less.

Here is A fraction of what's included in the book

The 10 most powerful tax strategies that wealthy business owners use (strategies your current CPA might not even know exist)

Real-world case studies showing exactly how each strategy works... with actual numbers from actual businesses

The specific questions to ask your CPA that will immediately tell you if they're working for you... or against you

$14.95

Download the ebook for just $14.95! Delivered instantly. Start reading in next 2 minutes.

Available for Instant Download!

Three months later, I'm at this accounting mastermind in Lake Tahoe...

Feeling like a fraud because I couldn't even help my own father...

When this older CPA starts talking about "proactive tax strategy."

Not filing taxes. STRATEGIZING them.

He mentioned business owners saving 30-50% on their tax bills using strategies written right into the tax code.

Legal strategies that most CPAs never learned because they were trained to prepare... not strategize.

It hit me like a ton of bricks.

What if I stopped thinking like a tax preparer...

And started thinking like a wealth protector?

What if instead of just calculating what people owe...

I could help them keep tens of thousands more in their own pockets?

And that’s when I changed the way I looked at taxes forever.

I went home and completely restructured how Dad's business operated from a tax perspective.

I didn't just fill out the forms differently...

I implemented a strategic system that worked WITH the tax code instead of against it.

And as a result…

My Dad saved $45,645 that first year.

Every penny of that money stayed in his pocket instead of going to Washington.

And every penny we saved was 100% legal for him to keep.

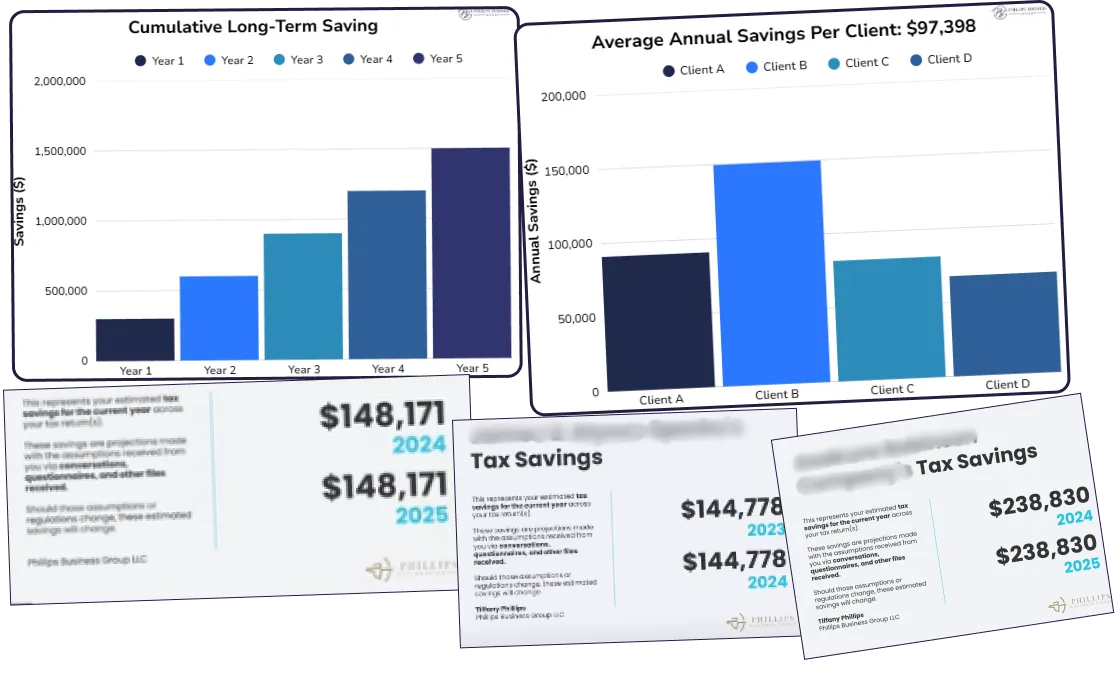

Since then, I've refined this system and helped hundreds of business owners across every industry...

Saving clients like Catherine $56,055...

Lindsay $52,738...

And countless others tens of thousands in their first year alone.

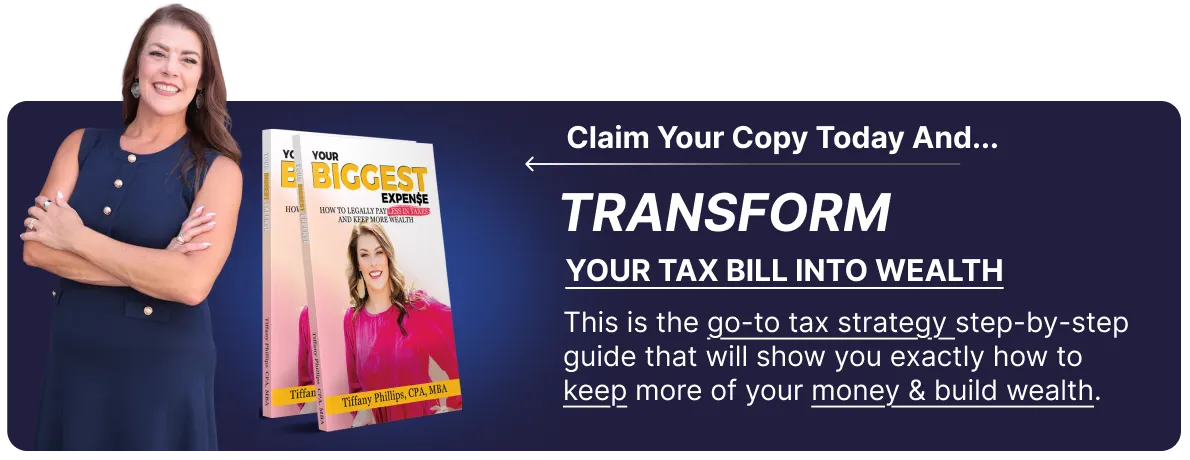

I'm now the author of "Your Biggest Expense: How to Legally Pay Less in Taxes and Keep More Wealth"...

Host of the Small Business Finance Podcast with over 300 episodes and 200,000+ downloads...

And I've been featured on dozens of news sites and other podcasts sharing these same strategies.

Most importantly...

I refuse to let brilliant entrepreneurs get dismissed by CPAs who are more worried about the IRS than their clients' success.

And now, if you’ll allow me, I’d like to show YOU how to use your money to build more wealth while paying less tax.

-

Introducing

"Your Biggest Expense" Book

How to Legally Pay Less in Taxes and Keep More Wealth

The 10-Strategy System That Transforms Your Biggest Business Expense

Into Your Greatest Wealth-Building Tool

The 10-Strategy System That Transforms Your Biggest Business Expense Into Your Greatest Wealth-Building Tool

I want you to imagine the future for a moment.

Tax Season, and instead of feeling that familiar dread creeping up your spine when you wonder just

how bad your tax bill is going to be...

You're actually looking forward to seeing how little you owe the IRS.

The most common reaction when I show people their tax bill is for them to say:

“Oh, is that it???”

This is the year you can keep tens of thousands more of your hard-earned money right where it belongs…

Even if the tax year is nearly over!

And in the years since I saved my Dad $45,645 on his tax bill... I've since refined what I’ve learned and created a bulletproof system that’s worked for hundreds of business owners.

So without further ado…

Here's what you'll discover inside my Brand New Book:

The 10 most powerful tax strategies that wealthy business owners use (strategies your current CPA might not even know exist)

Real-world case studies showing exactly how each strategy works... with actual numbers from actual businesses

The specific questions to ask your CPA that will immediately tell you if they're working for you... or against you

100% Secure 256-Bit Security Encryption

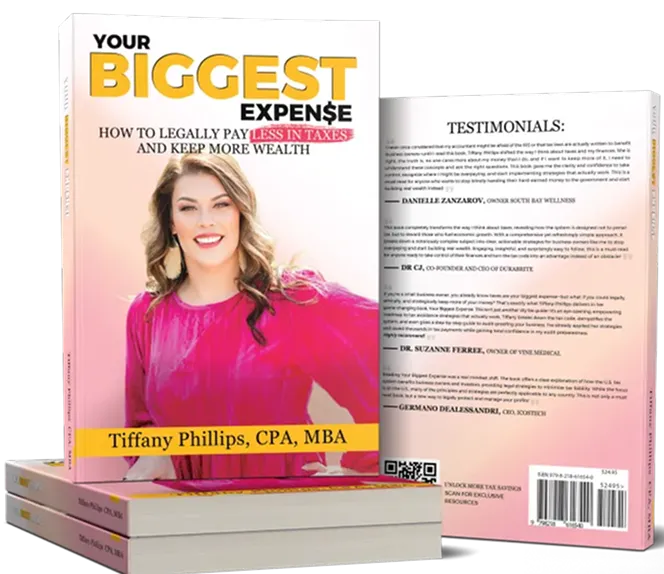

Don't Just Take My Word For It...

"I never once considered that my accountant might be afraid of the IRS or that tax laws are actually written to benefit business owners—until I read this book. It shifted the way I think about taxes and my finances. She is right, the truth is, no one cares more about my money than I do, and if I want to keep more of it, I need to understand these concepts and ask the right questions. This book gave me the clarity and confidence to take control, recognize where I might be overpaying, and start implementing strategies that actually work. This is a must-read for anyone who wants to stop blindly handing their hard-earned money to the government and start building real wealth instead."

“I just finished reading Your Biggest Expense, and it was absolutely eye-opening. The way it breaks down complex tax strategies into clear, actionable insights makes it an essential guide for business owners. It’s truly a game-changer when these strategies are applied.”

- Jeremiah Townsend,

Owner of IBA United

⭐️⭐️⭐️⭐️⭐️

“Reading Your Biggest Expense was a real mindset shift. It reveals how the tax system is built to reward those who drive economic growth, while offering practical strategies to minimize tax liability. Though focused on the U.S., many of the principles apply

globally.”

- Germano Dealessandri,

CEO of ICOSTECH

⭐️⭐️⭐️⭐️⭐️

“This book completely changed the way I think about taxes. It shows how the system is designed to benefit business owners who create value, while simplifying a notoriously complex subject. With its straightforward approach, it delivers strategies to stop overpaying & start building lasting wealth.”

- Dr CJ,

Co-founder of DuraBrite

⭐️⭐️⭐️⭐️⭐️

"If you're a small business owner, you already know taxes are your biggest expense but what if you could legally, ethically, and strategically keep more of your money? That’s exactly what Tiffany Phillips delivers in her game-changing book, Your Biggest Expense. This isn’t just another dry tax guide it’s an eye-opening, empowering roadmap to tax avoidance strategies that actually work. Tiffany breaks down the tax code, demystifies the system, and even gives a step-by-step guide to audit-proofing your business. I've already applied her strategies and saved thousands in tax payments while gaining total confidence in my audit preparedness. Highly recommend!"

100% Secure 256-Bit Security Encryption

Here's EVERYTHING You Get When You Order "Your Biggest Expense" Today:

THE CORE BOOK:

"Your Biggest Expense: How to Legally Pay Less in Taxes

and Keep More Wealth" ($14.95 Value)

The complete 10-strategy system that saved my dad $$45,645.

Real-world case studies showing exactly how each strategy works

Step-by-step implementation guides for every strategy I know so you’re working with the tax code, not against it.

The 3 warning signs your CPA is working for the IRS, not you

LIMITED-TIME BONUS BUNDLE INCLUDED WITH YOUR ORDER

When you order "Your Biggest Expense" today, you’ll also get instant access to these exclusive,

limited-time bonuses to help you save even more on taxes and protect your wealt

Bonus #1

"85 Tax Strategies To Save Thousands

In Taxes" Mini Course

The same proprietary 85-point tax reduction strategy we use with clients who save an average of $97,398 annually

Includes detailed breakdowns of each strategy with clear implementation steps

Covers strategies for businesses of all sizes and industries

Bonus #2

Exclusive Tax Bonus Guide

Three powerful bonus tax-saving strategies not included in the book

IRS-approved methods to maximize your deductions

Detailed implementation steps to legally reduce your tax bill

Bonus #3

"Tax Secrets Guide: Reduce Your Taxes & Audit-Proof Your Savings" Audio Course

Complete audio course with accompanying workbook

Learn how to audit-proof your business while maximizing deductions

Ensure all your tax strategies are legal and protected from IRS scrutiny

Bonus #4

"Your Biggest Expense" Audio Book

Listen on-the-go with the professional audiobook version

Access tax-saving strategies anytime, anywhere

Total Real-World Value: $997

YOUR INVESTMENT TODAY :

Just $14.95

You Save: $982.05

100% Secure 256-Bit Security Encryption

My "Tax Savings or Your Money Back" Guarantee

I'm so confident this book will save you thousands in taxes that I'm offering an unprecedented guarantee:

Read the book, implement at least 3 strategies, and if you don't save at least 10 times your investment ($470) in taxes within 12 months, I'll refund every penny.

No questions asked. No hoops to jump through. Just email us with your receipt and we'll process your refund immediately.

This means you're either saving thousands in taxes... or you're getting a $111 value book for free.

Either way, you win.

WARNING!

This Offer Won't Last Forever

Here’s why this is urgent:

Tax laws are changing rapidly - strategies that work today may not work tomorrow

The national debt is approaching $40 trillion - and if nothing changes tax rates WILL have to increase in the next few years

Every day you wait costs you approximately $150 in potential tax savings…

And the business owners who take action now will have a massive advantage over those who wait.

You Now Stand at a Crossroads

Path 1

Continue overpaying the IRS by 20-50% every year and watch tens of thousands of your hard-earned dollars disappear into government coffers.

Path 2

Invest $14.95 today to learn the same strategies that saved my dad $45,645 and could save you even more.

🤔

The Choice is Yours

But choose quickly - because if you wait the IRS will make the decision for you in April.

-

Here’s What to Do Next

Sep 1: Click the button below to secure your copy

Step 2: Enter your shipping information (takes 2 minutes)

Step 3: Start reading and implementing immediately

In just 2 minutes from now, you'll have access to the same strategies that have saved my clients hundreds of thousands in taxes. By this time next year, you could be celebrating your biggest tax savings ever.

100% Secure 256-Bit Security Encryption

GET ACCESS ONLY FOR $14.95

YOU’RE SAVING $982.05 TODAY

Bonuses Will Be Delivered Instantly. Get Full Access

Right Away.

100% Secure 256-Bit Security Encryption

Frequently Asked Questions

100% Secure 256-Bit Security Encryption

Q: Who is book this for?

A: "Your Biggest Expense" is perfect for business owners earning $100K+ annually who are tired of overpaying taxes and want to keep more of their hard-earned money.

Q: How quickly will I see the results?

A: Most business owners can implement at least 2-3 strategies immediately and see savings on their next quarterly tax payment.

Q: What if I am not good with financial stuff?

A: That's exactly why I wrote this book in plain English with step-by-step instructions. If you can follow a recipe, you can implement these strategies.

Q: Will this work with my current CPA?

A: Absolutely. In fact, Chapter 1 shows you exactly how to determine if your CPA is working for you or the IRS, and what to do either way.

Q: What if I don't save money?

A: Then you get your money back. Simple as that. I'm so confident in these strategies that I guarantee you'll save at least 10x your investment or I'll refund every penny.

100% Secure 256-Bit Security Encryption

Still on

the fence? Remember...

You're protected by our iron-clad guarantee

You get $111 worth of value for just $14.95

Every day you wait costs you potential tax savings

The only way you can lose is by not taking action today

100% Secure 256-Bit Security Encryption

Bonus #1

"85 Tax Strategies To Save Thousands In Taxes" Mini Course

The same proprietary 85-point tax reduction strategy we use with clients who save an average of $97,398 annually

Includes detailed breakdowns of each strategy with clear implementation steps

Covers strategies for businesses of all sizes and industries

Bonus #2

Exclusive Tax Bonus Guide

Three powerful bonus tax-saving strategies not included in the book

IRS-approved methods to maximize your deductions

Detailed implementation steps to legally reduce your tax bill

Bonus #3

"Tax Secrets Guide: Reduce Your Taxes & Audit-Proof Your Savings" Audio Course

Complete audio course with accompanying workbook

Learn how to audit-proof your business while maximizing deductions

Ensure all your tax strategies are legal and protected from IRS scrutiny

Bonus #4

"Your Biggest Expense" Audio Book

Listen on-the-go with the professional audiobook version

Access tax-saving strategies anytime, anywhere

100% Secure 256-Bit Security Encryption

100% Secure 256-Bit Security Encryption

GET YOUR COPY NOW

100% Secure 256-Bit Security Encryption

P.S. Remember, this isn't just about saving money on taxes—it's about taking control of your financial future. The strategies in this book have already saved my clients hundreds of thousands of dollars, and are all 100% legal.

The question isn't whether these strategies work (they do), but whether you'll implement them. Order now and start keeping more of what you earn.

100% Secure 256-Bit Security Encryption

Copyright © 2026 |Phillips Business Group LLC| All Rights Reserved

NOTE FACEBOOK™: This site is not a part of the Facebook™ website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.