How To Build Wealth Instead Of Paying Taxes

The Tax Code Has 10 Legal Loopholes Designed For Your Business — Your

CPA Just Never Told You About Them

The Tax Code Has 10 Legal Loopholes Designed For Your Business — Your CPA Just Never Told You About Them

New Book Reveals: The 10-Strategy System That Helped 400+ Business Owners Keep

an Extra $30K-$100K+ This Year (Without Changing CPAs or Risking Audits)

New Book Reveals: The 10-Strategy System That Helped 400+ Business Owners Keep an Extra $30K-$100K+ This Year (Without Changing CPAs or Risking Audits)

100% Secure 256-Bit Security Encryption

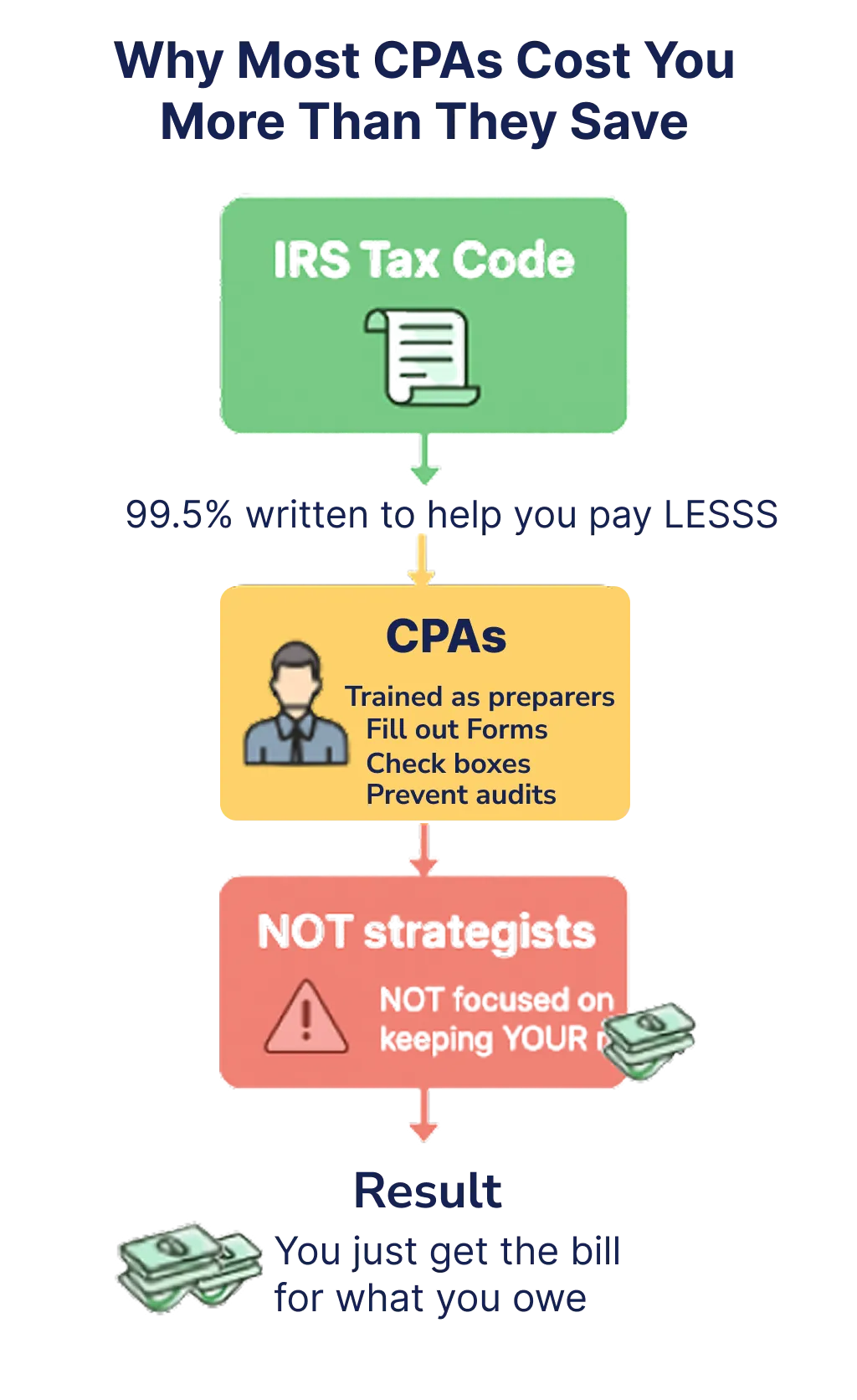

Most Business Owners Overpay The IRS By $30,000-$100,000+ Every Single Year — Here's Why:

Your CPA wasn't trained to find tax savings.

They were trained to prepare tax returns.

There's a massive difference.

Tax preparers make sure your forms are correct and you don't get audited.

Tax strategists know the 10 legal strategies that keep tens of thousands more in your pocket.

The problem? 90% of CPAs are preparers, not strategists.

Which means every April, you're paying full price on a tax bill that could be 30-50% lower.

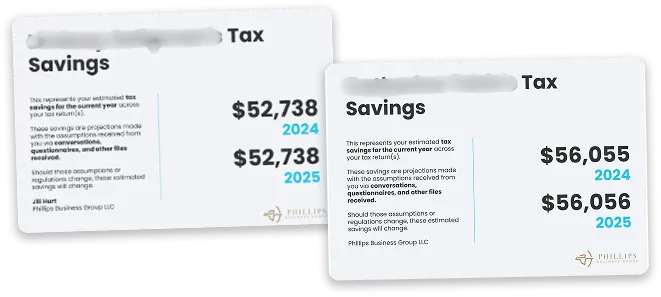

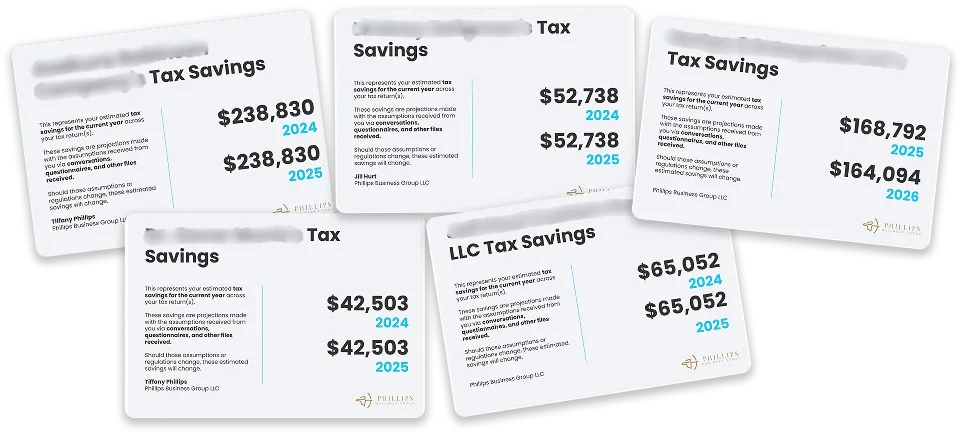

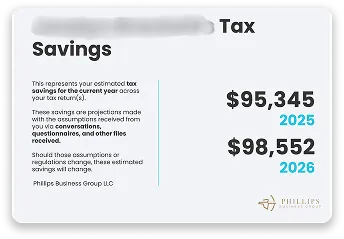

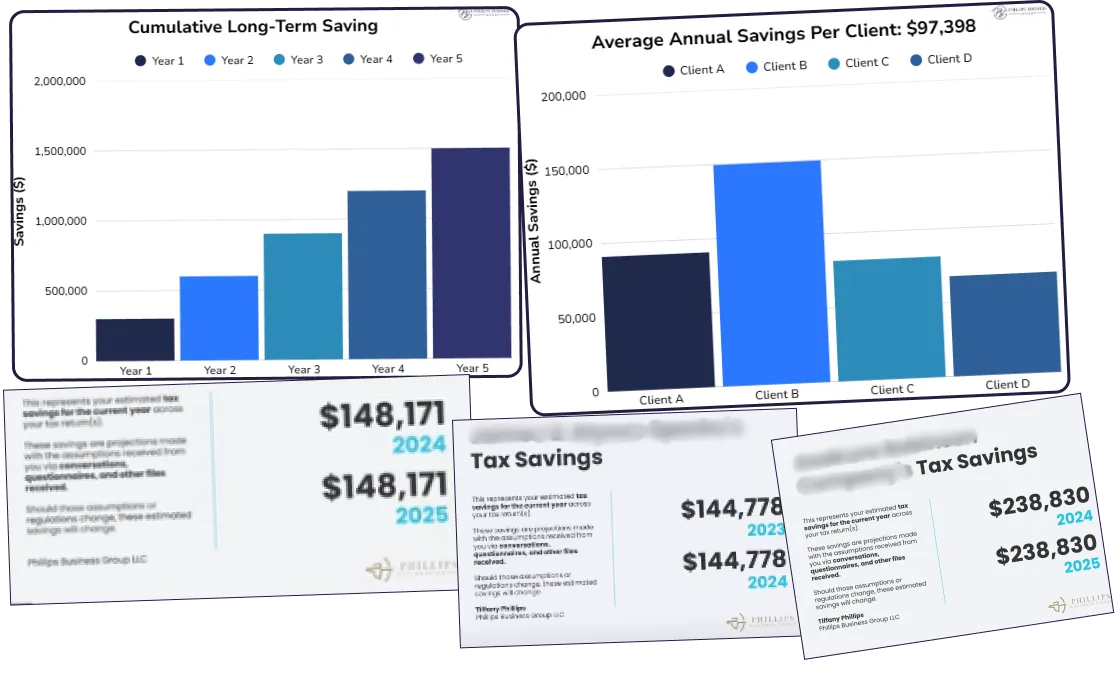

Catherine (INDUSTRY): Saved $56,055 in year one.

Lindsay (INDUSTRY): Saved $52,738 in year one.

My own father (Construction): Saved $45,645 in year one [Screenshot]

All using the same 10 strategies you're about to discover.

All 100% legal and IRS-approved.

All implemented by their EXISTING CPA (you don't need to switch).

DOWNLOAD "YOUR BIGGEST

EXPENSE" BOOK NOW!

Only $997 $14.95

Save $982.05 today!

DOWNLOAD THE EBOOK FOR JUST $14.95! DELIVERED INSTANTLY.START READING IN NEXT 2 MINUTES.

100% Secure 256-Bit Security Encryption

Bonuses will be delivered instantly.

Get full access right away.

"But Wait — If These Strategies Are Legal, Why Doesn't My CPA Already Use Them?"

Great question.

You’re very familiar with the part of the tax code that has you sending the IRS eye-watering checks every year…

But here's what most people don't know:

As a business owner, 99.5% of the U.S. tax code is actually written to REDUCE your taxes, not increase them.

The government WANTS you to use these strategies.

Because when you keep more money, you invest it back into your business, hire more people, and grow the economy.

The tax code literally rewards business owners who create jobs and drive economic growth.

But here's the problem:

Most CPAs spend their education learning tax compliance (how to file correctly), not tax strategy (how to pay less legally).

They know how to fill out Form 1120 perfectly.

They don't know the 10 strategies that could save you $50,000+.

It's not that they're bad at their job.

It's that they were never trained to do THIS part of the job.

GET INSTANT ACCESS

Today Only - $14:95

INCLUDED WITH YOUR ORDER

"85 Tax Strategies To Save Thousands In Taxes" Mini Course

Covers strategies for businesses of all sizes and industries

Exclusive Tax Bonus Guide

Three powerful bonus tax-saving strategies not included in the book

"Tax Secrets Guide: Reduce Your Taxes & Audit-Proof Your Savings" Audio Course

Complete audio course with accompanying workbook

"Your Biggest Expense" Audio Book

Access tax-saving strategies anytime, anywhere

WORD FROM OUR AMAZING CLIENTS

I Never Planned To Help People Turn Their Taxes Into Wealth…

That changed the night my Dad called me at 11 PM on a random Tuesday.

My dad's voice was shaking.

His construction business just had its best year ever — after decades of work:

$340,000 in profit.

But his CPA had just told him…

He owed $127,000 in taxes.

Even if he drained every dollar from his bank account, he'd barely have enough.

And there I was — CPA credentials on my wall — feeling completely powerless to help my own father.

I tried everything I'd been taught. Called every colleague I knew.

Nobody could help.

That's when I realized: Everything I'd learned was about compliance, not strategy.

I knew how to FILE taxes correctly.

I didn't know how to legally REDUCE them.

Three months later, I'm at an accounting conference in Lake Tahoe...

Feeling like a complete fraud because I couldn't even help my own dad...

When this veteran CPA starts talking about "proactive tax planning."

He mentioned business owners saving 30-50% using strategies written RIGHT INTO the tax code.

Strategies that were completely legal.

Strategies most CPAs never learned.

It hit me like a ton of bricks.

What if I stopped thinking like a tax preparer and started thinking like a wealth protector?

I flew home and completely restructured my dad's business from a tax perspective.

I didn't just fill out forms differently — I implemented strategic systems that worked WITH the tax code.

The result?

My dad saved $45,645 that first year.

Every penny stayed in his pocket.

Every penny was 100% legal.

But here's where it gets interesting...

I started wondering: Was this a fluke? Or could this work for other business owners?

So I began implementing these same strategies with my other clients.

E-commerce brands. Consultants. Real estate investors. Service businesses.

They all started saving massive amounts:

In all, 400+ business owners have saved an average of over $97,000 annually.

Here's What $97,000 In Tax Savings Actually Means:

Here is A fraction of what's included in the book

The 10 most powerful tax strategies that wealthy business owners use (strategies your current CPA might not even know exist)

Real-world case studies showing exactly how each strategy works... with actual numbers from actual businesses

The specific questions to ask your CPA that will immediately tell you if they're working for you... or against you

$14.95

Download the ebook for just $14.95! Delivered instantly. Start reading in next 2 minutes.

Available for Instant Download!

Three months later, I'm at this accounting mastermind in Lake Tahoe...

Feeling like a fraud because I couldn't even help my own father...

When this older CPA starts talking about "proactive tax strategy."

Not filing taxes. STRATEGIZING them.

He mentioned business owners saving 30-50% on their tax bills using strategies written right into the tax code.

Legal strategies that most CPAs never learned because they were trained to prepare... not strategize.

It hit me like a ton of bricks.

What if I stopped thinking like a tax preparer...

And started thinking like a wealth protector?

What if instead of just calculating what people owe...

I could help them keep tens of thousands more in their own pockets?

And that’s when I changed the way I looked at taxes forever.

I went home and completely restructured how Dad's business operated from a tax perspective.

I didn't just fill out the forms differently...

I implemented a strategic system that worked WITH the tax code instead of against it.

And as a result…

My Dad saved $45,645 that first year.

Every penny of that money stayed in his pocket instead of going to Washington.

And every penny we saved was 100% legal for him to keep.

Since then, I've refined this system and helped hundreds of business owners across every industry...

Saving clients like Catherine $56,055...

Lindsay $52,738...

And countless others tens of thousands in their first year alone.

Here's What $97,000 In Tax Savings Actually Means:

My dad didn't just save $45,645 that first year.

Over the past 8 years, he's saved over $380,000 using these same strategies.

Do you know what $380,000 does?

It completely changes your retirement timeline.

Instead of worrying about money, he's planning how to spend more time with his grandkids.

That's what tax savings actually means.

And here's the thing:

You don't need to save $97,000 for this to be life-changing.

Even if you save just $30,000 — that's still:

$97,000 isn't just a number on a tax return.

That's:

→ A fully-funded retirement account that compounds to $2.1M over 20 years at 8% returns

→ The down payment on a $485,000 rental property that generates $3,200/month in passive income

→ Your kids' entire college education paid for without touching your business capital

→ Two weeks in Europe with your family every single year — all-inclusive, first class flights, five-star hotels — and you'd STILL have $72,000 left over

→ A new car paid in cash (no payment, no interest) with enough left to max out your retirement accounts

Or here's my favorite:

Invest that $97,000 back into your business — new hires, better systems, marketing that actually works — and watch it turn into $300K+ in additional revenue.

See, most business owners think tax savings just means "keeping more money."

But that's not what this is really about.

This is about BUILDING WEALTH.

Because every dollar you keep from the IRS is a dollar that can:

Compound in investments

Generate passive income

Fund your next growth phase

Give you actual financial freedom

A family vacation you've been putting off

Your emergency fund fully funded

Six months of mortgage payments

Or $659,000 in retirement wealth if you invest it over 20 years

The money you're handing to the IRS right now could be funding YOUR dreams instead.

And it's 100% legal to keep it.

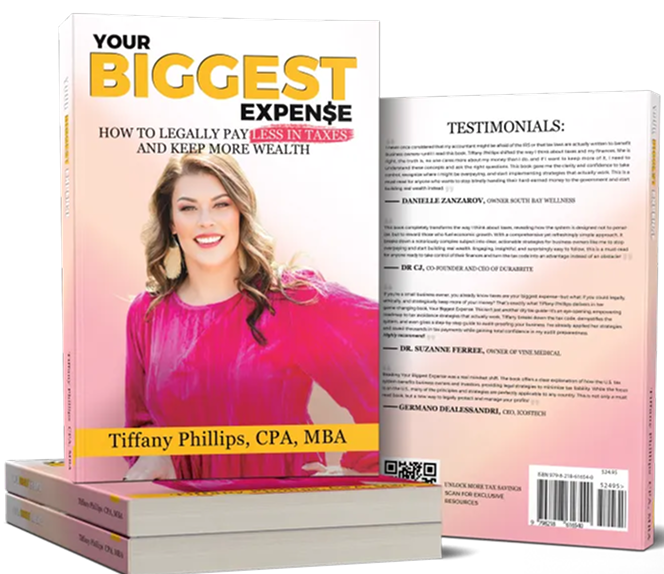

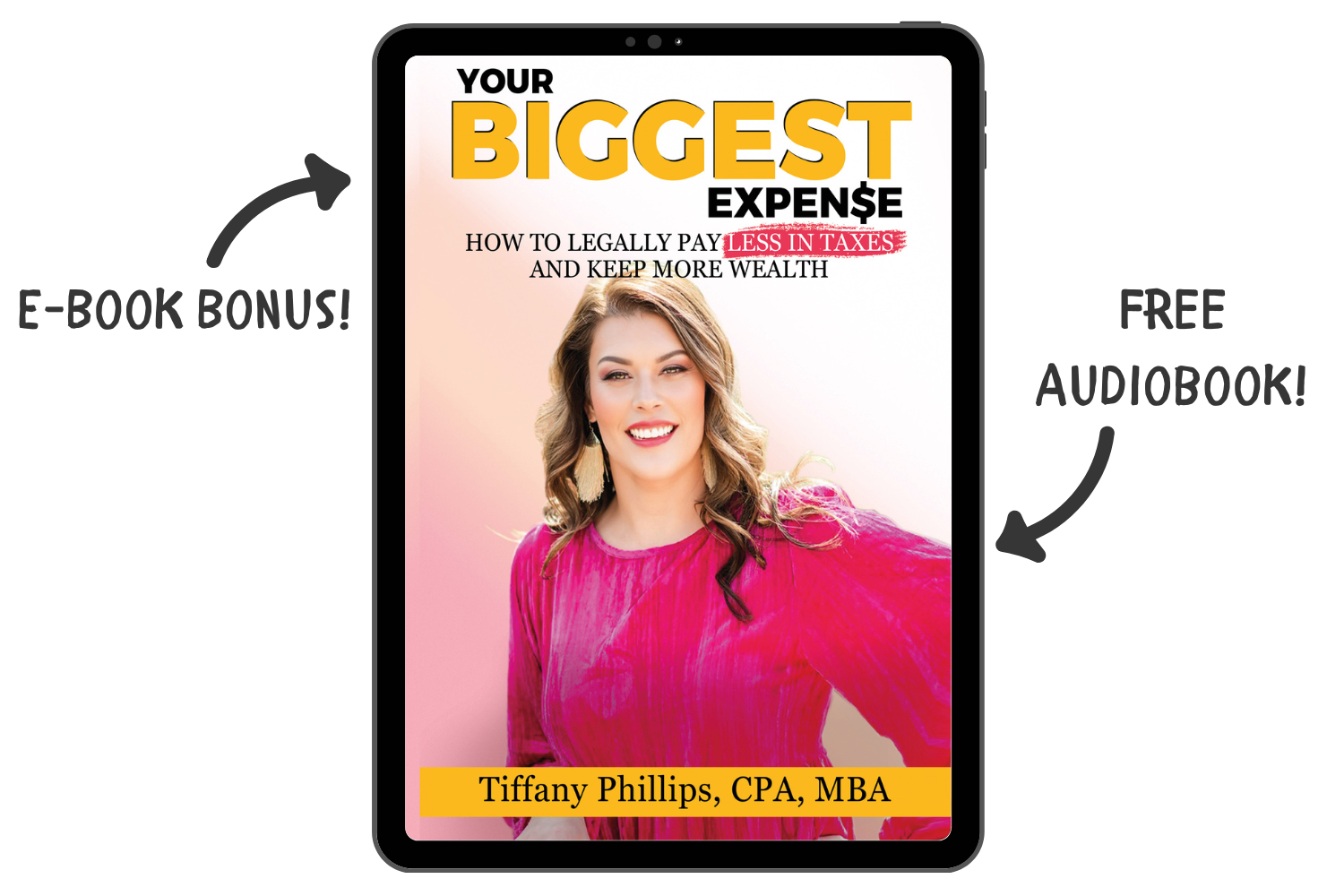

Now I'm sharing everything in my new book: "Your Biggest Expense: How to Legally Pay Less in Taxes and Keep More Wealth"

-

Introducing

"Your Biggest Expense" Book

How to Legally Pay Less in Taxes and Keep More Wealth

The 10-Strategy System That Transforms Your Biggest Business Expense

Into Your Greatest Wealth-Building Tool

The 10-Strategy System That Transforms Your Biggest Business Expense Into Your Greatest Wealth-Building Tool

I want you to imagine the future for a moment.

Tax Season, and instead of feeling that familiar dread creeping up your spine when you wonder just

how bad your tax bill is going to be...

You're actually looking forward to seeing how little you owe the IRS.

The most common reaction when I show people their tax bill is for them to say:

“Oh, is that it???”

This is the year you can keep tens of thousands more of your hard-earned money right where it belongs…

Even if the tax year is nearly over!

And in the years since I saved my Dad $45,645 on his tax bill... I've since refined what I’ve learned and created a bulletproof system that’s worked for hundreds of business owners.

So without further ado…

Here's what you'll discover inside my Brand New Book:

The 10 most powerful tax strategies that wealthy business owners use (strategies your current CPA might not even know exist)

Real-world case studies showing exactly how each strategy works... with actual numbers from actual businesses

The specific questions to ask your CPA that will immediately tell you if they're working for you... or against you

100% Secure 256-Bit Security Encryption

Don't Just Take My Word For It...

"I never once considered that my accountant might be afraid of the IRS or that tax laws are actually written to benefit business owners—until I read this book. It shifted the way I think about taxes and my finances. She is right, the truth is, no one cares more about my money than I do, and if I want to keep more of it, I need to understand these concepts and ask the right questions. This book gave me the clarity and confidence to take control, recognize where I might be overpaying, and start implementing strategies that actually work. This is a must-read for anyone who wants to stop blindly handing their hard-earned money to the government and start building real wealth instead."

“I just finished reading Your Biggest Expense, and it was absolutely eye-opening. The way it breaks down complex tax strategies into clear, actionable insights makes it an essential guide for business owners. It’s truly a game-changer when these strategies are applied.”

- Jeremiah Townsend,

Owner of IBA United

⭐️⭐️⭐️⭐️⭐️

“Reading Your Biggest Expense was a real mindset shift. It reveals how the tax system is built to reward those who drive economic growth, while offering practical strategies to minimize tax liability. Though focused on the U.S., many of the principles apply

globally.”

- Germano Dealessandri,

CEO of ICOSTECH

⭐️⭐️⭐️⭐️⭐️

“This book completely changed the way I think about taxes. It shows how the system is designed to benefit business owners who create value, while simplifying a notoriously complex subject. With its straightforward approach, it delivers strategies to stop overpaying & start building lasting wealth.”

- Dr CJ,

Co-founder of DuraBrite

⭐️⭐️⭐️⭐️⭐️

"If you're a small business owner, you already know taxes are your biggest expense but what if you could legally, ethically, and strategically keep more of your money? That’s exactly what Tiffany Phillips delivers in her game-changing book, Your Biggest Expense. This isn’t just another dry tax guide it’s an eye-opening, empowering roadmap to tax avoidance strategies that actually work. Tiffany breaks down the tax code, demystifies the system, and even gives a step-by-step guide to audit-proofing your business. I've already applied her strategies and saved thousands in tax payments while gaining total confidence in my audit preparedness. Highly recommend!"

100% Secure 256-Bit Security Encryption

Here's EVERYTHING You Get When You Order "Your Biggest Expense" Today:

THE CORE BOOK:

"Your Biggest Expense: How to Legally Pay Less in Taxes

and Keep More Wealth" ($14.95 Value)

The complete 10-strategy system that saved my dad $$45,645.

Real-world case studies showing exactly how each strategy works

Step-by-step implementation guides for every strategy I know so you’re working with the tax code, not against it.

The 3 warning signs your CPA is working for the IRS, not you

LIMITED-TIME BONUS BUNDLE INCLUDED WITH YOUR ORDER

When you order "Your Biggest Expense" today, you’ll also get instant access to these exclusive,

limited-time bonuses to help you save even more on taxes and protect your wealt

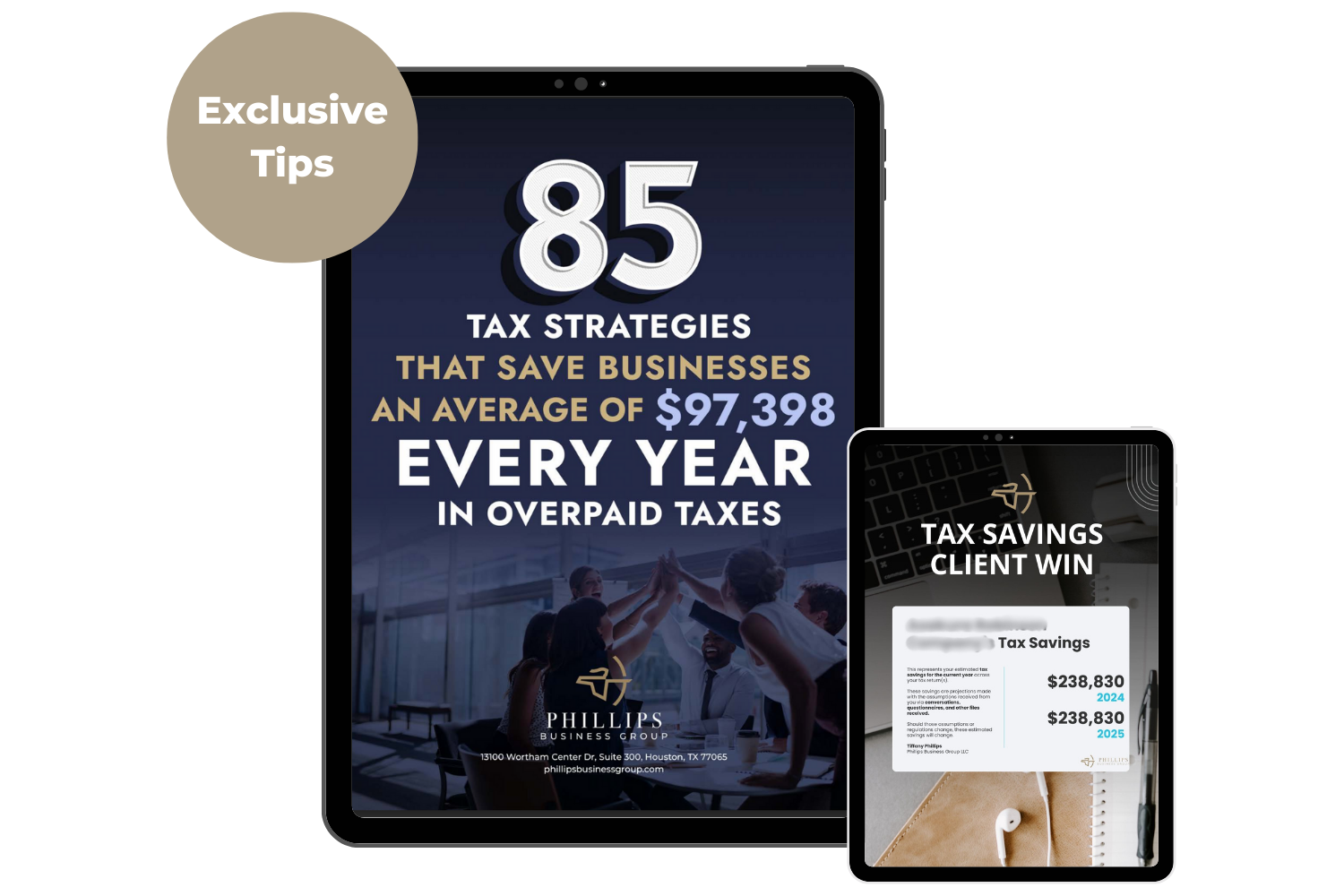

Bonus #1

"85 Tax Strategies To Save Thousands

In Taxes" Mini Course

The same proprietary 85-point tax reduction strategy we use with clients who save an average of $97,398 annually

Includes detailed breakdowns of each strategy with clear implementation steps

Covers strategies for businesses of all sizes and industriesGet your sales funnel live in under an hour

Bonus #2

Exclusive Tax Bonus Guide

Three powerful bonus tax-saving strategies not included in the book

IRS-approved methods to maximize your deductions

Detailed implementation steps to legally reduce your tax bill

Bonus #3

"Tax Secrets Guide: Reduce Your Taxes & Audit-Proof Your Savings" Audio Course

Complete audio course with accompanying workbook

Learn how to audit-proof your business while maximizing deductions

Ensure all your tax strategies are legal and protected from IRS scrutiny

Bonus #4

"Your Biggest Expense" Audio Book

Listen on-the-go with the professional audiobook version

Access tax-saving strategies anytime, anywhere

Total Real-World Value: $997

YOUR INVESTMENT TODAY :

Just $14.95

You Save: $982.05

100% Secure 256-Bit Security Encryption

My "Tax Savings or Your Money Back" Guarantee

I'm so confident this book will save you thousands in taxes that I'm offering an unprecedented guarantee:

Read the book, implement at least 3 strategies, and if you don't save at least 10 times your investment ($470) in taxes within 12 months, I'll refund every penny.

No questions asked. No hoops to jump through. Just email us with your receipt and we'll process your refund immediately.

This means you're either saving thousands in taxes... or you're getting a $111 value book for free.

Either way, you win.

WARNING!

This Offer Won't Last Forever

Here’s why this is urgent:

Tax laws are changing rapidly - strategies that work today may not work tomorrow

The national debt is approaching $40 trillion - and if nothing changes tax rates WILL have to increase in the next few years

Every day you wait costs you approximately $150 in potential tax savings…

And the business owners who take action now will have a massive advantage over those who wait.

You Now Stand at a Crossroads

Path 1

Continue overpaying the IRS by 20-50% every year and watch tens of thousands of your hard-earned dollars disappear into government coffers.

Path 2

Invest $14.95 today to learn the same strategies that saved my dad $45,645 and could save you even more.

🤔

The Choice is Yours

But choose quickly - because if you wait the IRS will make the decision for you in April.

-

Here’s What to Do Next

Sep 1: Click the button below to secure your copy

Step 2: Enter your shipping information (takes 2 minutes)

Step 3: Start reading and implementing immediately

In just 2 minutes from now, you'll have access to the same strategies that have saved my clients hundreds of thousands in taxes. By this time next year, you could be celebrating your biggest tax savings ever.

100% Secure 256-Bit Security Encryption

GET ACCESS ONLY FOR $14.95

YOU’RE SAVING $982.05 TODAY

Bonuses Will Be Delivered Instantly. Get Full Access

Right Away.

100% Secure 256-Bit Security Encryption

Frequently Asked Questions

100% Secure 256-Bit Security Encryption

Q: Who is book this for?

A: "Your Biggest Expense" is perfect for business owners earning $100K+ annually who are tired of overpaying taxes and want to keep more of their hard-earned money.

Q: How quickly will I see the results?

A: Most business owners can implement at least 2-3 strategies immediately and see savings on their next quarterly tax payment.

Q: What if I am not good with financial stuff?

A: That's exactly why I wrote this book in plain English with step-by-step instructions. If you can follow a recipe, you can implement these strategies.

Q: Will this work with my current CPA?

A: Absolutely. In fact, Chapter 1 shows you exactly how to determine if your CPA is working for you or the IRS, and what to do either way.

Q: What if I don't save money?

A: Then you get your money back. Simple as that. I'm so confident in these strategies that I guarantee you'll save at least 10x your investment or I'll refund every penny.

100% Secure 256-Bit Security Encryption

Still on

the fence? Remember...

You're protected by our iron-clad guarantee

You get $111 worth of value for just $14.95

Every day you wait costs you potential tax savings

The only way you can lose is by not taking action today

100% Secure 256-Bit Security Encryption

Bonus #1

"85 Tax Strategies To Save Thousands In Taxes" Mini Course

The same proprietary 85-point tax reduction strategy we use with clients who save an average of $97,398 annually

Includes detailed breakdowns of each strategy with clear implementation steps

Covers strategies for businesses of all sizes and industriesGet your sales funnel live in under an hour

Bonus #2

Exclusive Tax Bonus Guide

Three powerful bonus tax-saving strategies not included in the book

IRS-approved methods to maximize your deductions

Detailed implementation steps to legally reduce your tax bill

Bonus #3

"Tax Secrets Guide: Reduce Your Taxes & Audit-Proof Your Savings" Audio Course

Complete audio course with accompanying workbook

Learn how to audit-proof your business while maximizing deductions

Ensure all your tax strategies are legal and protected from IRS scrutiny

Bonus #4

"Your Biggest Expense" Audio Book

Listen on-the-go with the professional audiobook version

Access tax-saving strategies anytime, anywhere

100% Secure 256-Bit Security Encryption

100% Secure 256-Bit Security Encryption

GET YOUR COPY NOW

100% Secure 256-Bit Security Encryption

P.S. Remember, this isn't just about saving money on taxes—it's about taking control of your financial future. The strategies in this book have already saved my clients hundreds of thousands of dollars, and are all 100% legal.

The question isn't whether these strategies work (they do), but whether you'll implement them. Order now and start keeping more of what you earn.

100% Secure 256-Bit Security Encryption

Copyright © 2025 |Phillips Business Group LLC| All Rights Reserved

NOTE FACEBOOK™: This site is not a part of the Facebook™ website or Facebook Inc. Additionally, This site is NOT endorsed by Facebook™ in any way. FACEBOOK™ is a trademark of FACEBOOK™, Inc.